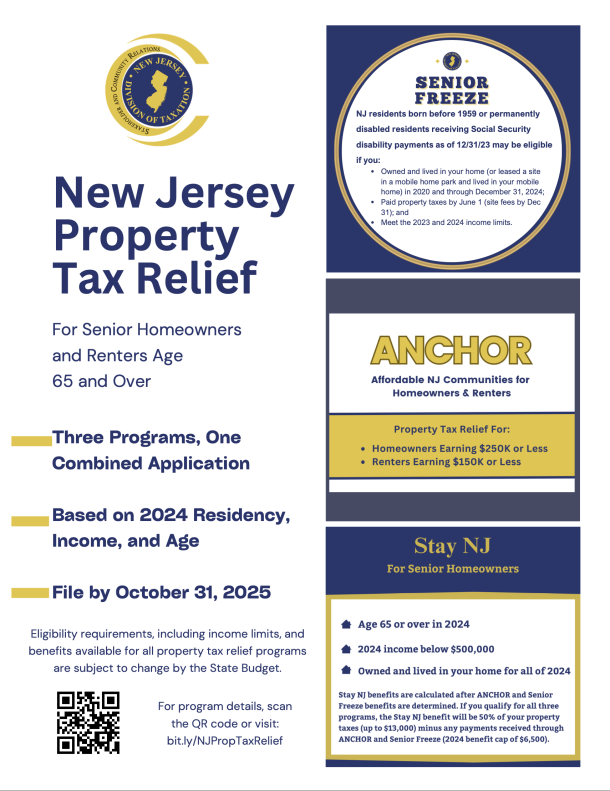

New Tax Form Combining The 3 Tax Relief Programs Now Available!

Changes to the PAS-1 form

Please note on Section III – Certain Homeowners

Initially stated in blue booklets mailed out:

Complete this section only if you answered “yes” at line 5a and moved before December 31, 2024

The new form online now states:

Complete this section only if you answered “yes” at line 5a

For those answering “No” on line 5A, they are ineligible to file the application and do not need to complete Schedule III. Line 5A is for those that were not residing in the same home for the full year (based on answer at line 4a). By indicating “No” on 5a, the applicant is additionally saying that they were not an owner or renter on October 1, 2024.

By indicating that they were not residing in the same home all year (Line 4a) and neither a homeowner or renter (Line 5a), the applicant would not be eligible for any of the programs: Senior Freeze, ANCHOR, or Stay NJ.

However, there was a printing error on Schedule III itself. Schedule III of the PAS-1 booklets that are being mailed to applicants incorrectly indicates that you should only complete the schedule if you moved before December 31. However, Schedule III should be completed by those who indicated “Yes” online 5a even if they DID move by December 31.

Taxation posted a statement about that error on their website and even revised the online PDF of the

form: NJ Division of Taxation - Property Tax Relief Programs